TL;DR

- Banks are usually more expensive. They have high transfer fees and the foreign exchange rates are not really favourable.

- All the services do not offer the same guarantees, transfer time, fees etc… Compare, compare and compare.

- A few cents difference in the exchange rate can lead to a huge difference in the amount received or transferred.

As expats, there is a moment when you need to send or receive money from/to your home country. It may be something regular such as property rent, salaries, pensions… Or for occasional events like birthdays, weddings and more. It is important to make the right choice when it is time to select a provider. Indeed, a great exchange rate can mean more money for you at the end.

Let’s check a few ways to send money abroad.

Banks Are – Generally – More Expensive

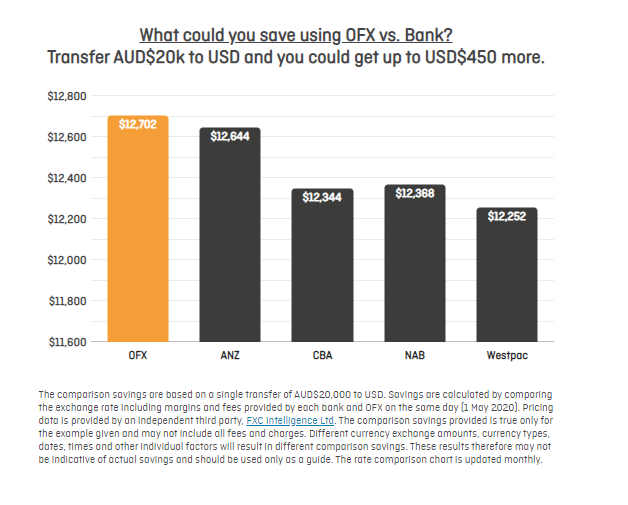

Yes, it looks tempting to ask your bank to transfer your money abroad. But the short answer is: they are not cheap. According to the ACCC, the big four (ANZ, Com Bank, NAB and Westpac) are the most expensive. The below graphic shows the difference between the best money service transfer and the worst bank rate results.

Banks generally have the worst exchange rate and they may also charge fees to the recipient. For example, if you send AUD $20K to the US with OFX, you could save up to USD $450 compared to the other options.

Source: OFX Website

Online Transfer Services

Rather than using a bank, a useful alternative is to send your money overseas via online transfer providers. There are tones of companies, from SendFx, TranserWise or OFX to WesternUnion to name only a few.

The biggest advantage is the competitive exchange rate and low transfer fees. The vast majority of these companies are 100% online, therefore they do not need to pay for locations across countries. This is why they can offer better exchange rates.

Contrary to banks, the transfer time is quite quick, it will take a few days to have the money on your bank account. Some services can even transfer your funds in a couple of hours!

Yet, there are some drawbacks to online services. You won’t have any someone to speak to in person: it is more impersonal and you will have to do the process by yourself. Also, there is a huge number of providers and it is not easy to find and to compare all the options.

Because the service is online, you must be careful about the provider you decide to go with. A pro tip is to make sure the provider you select is regulated with the Australian Securities & Investment Commission

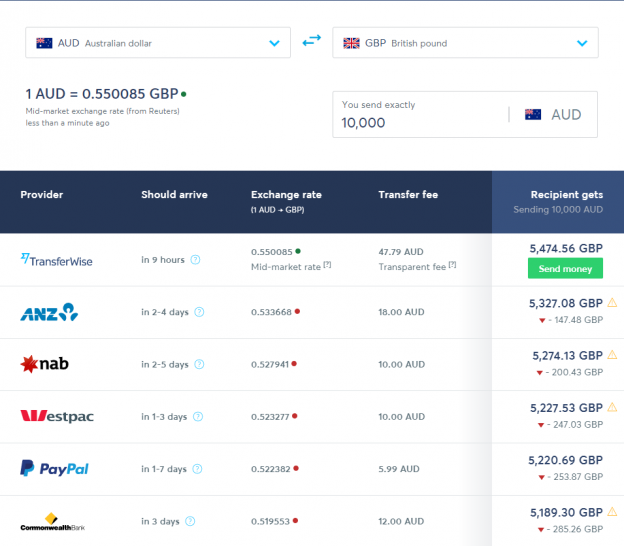

Compare, Compare and Compare Again

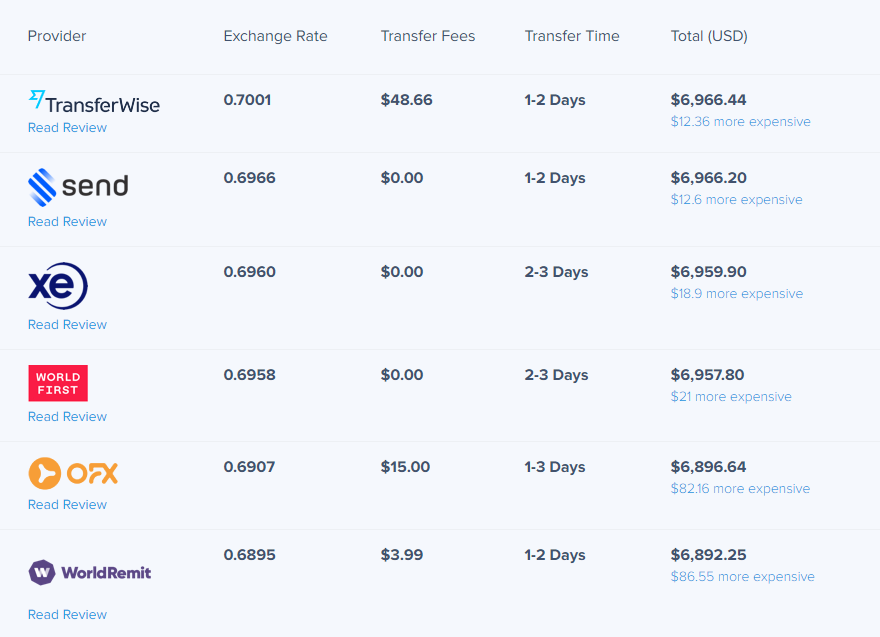

In a world of constant changes and as we are all different, it is imperative to compare services. You can save a lot of money by comparing banks vs online transfer companies.

Image Source: Transferwise

Yes, banks are more expensive most of the time, but it is not always true. Depending on your bank, the relationship you have with your banker, some fees might be waved. With the online solutions, as they are so many, you will need to be careful of the scams because once the money is sent, it is almost impossible to get it back. You can visit scamwatch to identify scams and protect yourself. Finder.com.au also put together a lost of thing to check when you transfer money overseas.

Finally, moneysmart.gov.au recommend comparing a few points when you send your money overseas from Australia:

- Currency (exchange rate): for example, how many euros you can have with 1 Australian dollar. You can check the exchange rate on the Reserve Bank of Australia

- Exchange rate guarantee: is your exchange rate is locked or subject to changes

- Transfer fees and commission: all the fees related to your transfer

- Payment and receive method: how it takes for the fund to be sent and received

- Transfer time: how long it takes to get your money

- Transfer amount: minimum and or a maximum transfer amount

Tips: At Palmers Relocations, we have partnered with SendFX who offer many benefits and cost savings. It’s just another way we offer our clients a truly end-to-end relocation experience.

Note: Palmers Relocations is not a financial adviser. The information provided in this article is general only and does not constitute financial advice. Palmers Relocations is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website.